south dakota vehicle sales tax calculator

United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state. The Lead South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Lead South Dakota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Lead South Dakota.

Ifta Calculator Tax Software Cool Photos Tax

You can find these fees further down on the page.

. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Law enforcement may ticket for driving on expired plates. South Dakota has recent rate changes Thu Jul 01 2021.

Calculating Sales Tax Summary. DMV fees are about 127 on a 39750 vehicle based on a 7560 license fee plus titling lien filing. Find out the estimated renewal cost of your vehicles.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation districts. 10 years old or older. The state sales and use tax rate is 45.

If you are unsure call any local car dealership and ask for the tax rate. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Click Search for Tax Rate. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees. The Motor Vehicle Division provides and maintains your motor vehicle records.

4 Motor Vehicle Excise Manual. Dealership employees are more in tune to tax rates than most government officials. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

The South Dakota Department of Revenue administers these taxes. Enter a street address and zip code or street address and city name into the provided spaces. 150 for echeck or 225 for debit or credit card.

For an exact price select Interested in vehicle registration during signup and our specialist will contact you. Detailed for South Dakota. Select the South Dakota city from the list of popular cities below to see its current sales tax rate.

For additional information on sales tax please refer to our Sales Tax Guide PDF. 0 for electric vehicles. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Non-commercial vehicles weighing up to 4 tons. Exact tax amount may vary for different items. Whether or not you have a trade-in.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. The Arlington South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Arlington South Dakota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Arlington South Dakota. Registration fees in South Dakota are based on the type age and weight of the vehicle.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The state in which you live. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Vehicle Leases Rentals Tax Fact 1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. Costs include the registration fees mailing fees mailing fee is 1 for each registration renewed and a processing fee. See how we can help improve your.

For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying. Your household income location filing status and number of personal exemptions. Municipalities may impose a general municipal sales tax rate of up to 2.

South Dakota SD Sales Tax Rates by City. Once you have a YBA physical mailbox number you can register your vehicle in South Dakota. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

0 through 9 years old. The state sales tax rate in South Dakota is 4500. With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax.

One exception is the sale or purchase of a motor vehicle which is subject to the. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on. With local taxes the total sales tax rate is between 4500 and 7500.

Searching for a sales tax rates based on zip codes alone will not work. The county the vehicle is registered in. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Purchase new license plates. Once you have the tax rate multiply it with the vehicles purchase price. South Dakota Sales Tax.

Ease of Switching Your Domicile State to South Dakota. Review and renew your vehicle registrationdecals and license plates. Motorcycles under 350 CC.

For vehicles that are being rented or leased see see taxation of leases and rentals. In our calculation the taxable amount is 41349 which equals the sale price of 39750 plus the doc fee of 149 plus the extended warranty cost of 3450 minus the trade-in value of 2000. The type of license plates requested.

You can do this on your own or use an online tax calculator. There are plenty of benefits for registering your vehicle in South Dakota. One of a suite of free online calculators provided by the team at iCalculator.

New car sales tax OR used car sales tax. Our online services allow you to. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

7 local rate on first 1600 275. Fees to Register a Car in SD. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. Actual cost may vary. Detailed for South Dakota.

Mobile Manufactured homes are subject to. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees. 2000 x 5 100.

Opt-in for email renewal and general notifications.

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Iowa State Sales Tax Guide Tax Guide Sales Tax Tax Holiday

Understanding California S Sales Tax

Sales Taxes In The United States Wikiwand

South Dakota Sales Tax Small Business Guide Truic

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes

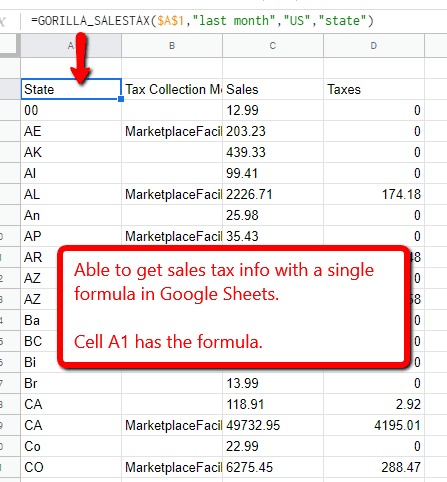

Amazon Fba Sales Tax For Sellers What Is Collected And What You Owe Gorilla Roi

Sales And Use Tax What Is The Difference Between Sales Use Tax

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Missouri Car Sales Tax Calculator Missouri Country Club Plaza Cars For Sale

How Do State And Local Sales Taxes Work Tax Policy Center

The Consumer S Guide To Sales Tax Taxjar Developers

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Woocommerce Sales Tax In The Us How To Automate Calculations

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels